A new standard of indexable inserts: a carefully designed complex shape for effective cutting action.

While cemented carbide indexable inserts are an integral part of cutting tools today, cemented carbide inserts were first introduced in the early ’60s and have substantially changed tool designs, putting tools with brazed carbide tips on the back burner. Mechanical clamping of the indexable inserts provided significant advantages in productivity, efficient use of carbide and tool maintenance.

Advances in technology and metallurgy have facilitated the development of indexable inserts that are far more advanced than their predecessors, and complicated shapes which have replaced the simple forms that characterized inserts in the past.

The shape of an insert is a key factor for cutting geometry of a tool as a whole. For example, when milling, geometry variation by means of changing the position of the insert in the tool is very limited, and the results are far from optimal. Effective machining demands constant rake and relief angles along the cutting edge, which in turn necessitate complicated contours of the top of the insert (and also bottom for double-sided inserts) and its periphery. A land that strengthens the cutting edge and a minor edge for better milling by ramping further increases the design’s complexity.

The insert must ensure precise control of the flow of chips produced by the cutting action, and so the chip breaker on the rake face adjoining the cutting edge must be specifically shaped. This is particularly important for turning, especially if a machined material produces long chips; here, the chip breaker controls the direction of the chip flow so that the chip overturns and breaks into smaller segments.

Finding the optimal insert shape for efficient cutting and chip control is not a simple task and tool manufacturers have leveraged new technologies to develop successful solutions.

Indexable inserts are sintered products

Integrating dedicated automated and computer controlled systems into the tool fabrication facilities ensured both stability and repeatability in the powder metallurgy processes. As a result, pressing complicated forms became possible without fear of cracks and a technological base for forming challenging geometries of inserts was developed.

A surface that ensures satisfactory chip control, particularly chip breaking, is a combination of concave and convex elements: grooves, bosses, etc. Manufacturing this surface by grinding is both very limited and expensive. This is one of the main reasons why the first generations of the indexable inserts featured flat forms. In contrast, with the use of powder metallurgy the rake face of an insert can be configured as desired.

Today, cutting tool design engineers have at their disposal advanced working tools such as computer-aided design (CAD) and modelling, which have essentially changed the process of insert development. The new methods have opened up the possibility of simulating various processes, such as chip formation and chip flow. Consequently, an optimal geometry may be designed on a computer by changing various parameters of the virtual insert.

Progress on both fronts – manufacturing technology and design methods – has led to important breakthroughs in the production of indexable inserts.

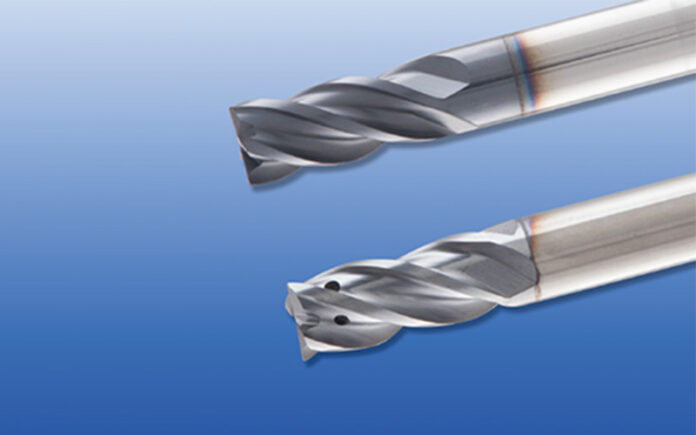

ISCAR’s insert IQ845 SYHU 0704 for face milling cutters is a good example of how computer modelling and advanced pressing have resulted in a successful product (Pic. 1).

ISCAR’s insert IQ845 SYHU 0704 for face milling cutters is a good example of how computer modelling and advanced pressing have resulted in a successful product (Pic. 1).

Computer modelling the chip flow has contributed significantly to optimizing the rake face shape for the family of ISCAR inserts CNMG-F3M (Pics. 2, 3) that was designed especially for the finish turning of ISO M materials (austenitic, precipitation hardening and duplex stainless steels).

Powder metallurgy is applied to the face of the insert as well as its cutting edge. For example, the inserts P290 ACKT of the ISCAR MILLSHRED family possess serrated cutting edges (Pic. 4) that are used as sintered. The serrated cutting edge shreds the chip and so greatly improves milling results in unstable conditions.

Powder metallurgy is applied to the face of the insert as well as its cutting edge. For example, the inserts P290 ACKT of the ISCAR MILLSHRED family possess serrated cutting edges (Pic. 4) that are used as sintered. The serrated cutting edge shreds the chip and so greatly improves milling results in unstable conditions.

The concept of a cutting tool with mechanically clamped inserts pushed aside brazed cutting edge applications once the industry learned to produce sintered inserts with acceptable accuracy and dimensional stability. However, for high-precision cutting, rotating solid carbide and also brazed tools still retain the lead. A one-piece integral cutter, ground with strict tolerance limits, always has the advantage in accuracy in comparison with an assembled tool with inserts. There is a viable indexable alternative that not only overcomes the lack of accuracy but improves the tool by making it both versatile and economical: an innovative yet simple modular cutter that can incorporate various replaceable solid carbide heads.

The concept of a cutting tool with mechanically clamped inserts pushed aside brazed cutting edge applications once the industry learned to produce sintered inserts with acceptable accuracy and dimensional stability. However, for high-precision cutting, rotating solid carbide and also brazed tools still retain the lead. A one-piece integral cutter, ground with strict tolerance limits, always has the advantage in accuracy in comparison with an assembled tool with inserts. There is a viable indexable alternative that not only overcomes the lack of accuracy but improves the tool by making it both versatile and economical: an innovative yet simple modular cutter that can incorporate various replaceable solid carbide heads.

ISCAR’s tool families target different types of machining: MULTI-MASTER (milling and drilling); T-SLOT (milling slots and grooves); SUMOCHAM, CHAMIQDRILL and CHAMDRILL (drilling); BAYO T-REAM (reaming). Manufacturing replaceable heads for the tools is based on technologicallyadvanced pressing and sintering processes. There are two kinds of heads. One is a tool of decreased length usually made of solid carbide, whereas the second head features a specific pre-sintered shape that is brought to final dimensions by fine grinding. Advances in powder metallurgy have influenced the second type of head, while technological progress has succeeded in producing highly specific shapes for improved cutting action and chip control that are very difficult or even simply impossible to reach by using grinding operations (Pic. 5).

ISCAR’s tool families target different types of machining: MULTI-MASTER (milling and drilling); T-SLOT (milling slots and grooves); SUMOCHAM, CHAMIQDRILL and CHAMDRILL (drilling); BAYO T-REAM (reaming). Manufacturing replaceable heads for the tools is based on technologicallyadvanced pressing and sintering processes. There are two kinds of heads. One is a tool of decreased length usually made of solid carbide, whereas the second head features a specific pre-sintered shape that is brought to final dimensions by fine grinding. Advances in powder metallurgy have influenced the second type of head, while technological progress has succeeded in producing highly specific shapes for improved cutting action and chip control that are very difficult or even simply impossible to reach by using grinding operations (Pic. 5).

The growth of modern technology opened the door for producing both the indexable inserts and the replaceable heads from cemented carbide in diverse shapes. This reflects the outcome of years of research and development in the field, and further illustrates ISCARs commitment to the development of machining performance. Essentially, an indexable cutting tool comprises only three components: the tool body, the insert or the head and a clamping element.

The growth of modern technology opened the door for producing both the indexable inserts and the replaceable heads from cemented carbide in diverse shapes. This reflects the outcome of years of research and development in the field, and further illustrates ISCARs commitment to the development of machining performance. Essentially, an indexable cutting tool comprises only three components: the tool body, the insert or the head and a clamping element.

The carefully shaped cutting area of this modern tool removes material directly despite its small dimension and uniform structure. ISCAR’s research and development division is committed to the evolution of smart cutting tool solutions and technologies to improve production processes in metal cutting.

For more information contact Iscar South Africa – Tel: 011 997 2700

ISCAR’s insert IQ845 SYHU 0704 for face milling cutters is a good example of how computer modelling and advanced pressing have resulted in a successful product (Pic. 1).

ISCAR’s insert IQ845 SYHU 0704 for face milling cutters is a good example of how computer modelling and advanced pressing have resulted in a successful product (Pic. 1). Powder metallurgy is applied to the face of the insert as well as its cutting edge. For example, the inserts P290 ACKT of the ISCAR MILLSHRED family possess serrated cutting edges (Pic. 4) that are used as sintered. The serrated cutting edge shreds the chip and so greatly improves milling results in unstable conditions.

Powder metallurgy is applied to the face of the insert as well as its cutting edge. For example, the inserts P290 ACKT of the ISCAR MILLSHRED family possess serrated cutting edges (Pic. 4) that are used as sintered. The serrated cutting edge shreds the chip and so greatly improves milling results in unstable conditions. The concept of a cutting tool with mechanically clamped inserts pushed aside brazed cutting edge applications once the industry learned to produce sintered inserts with acceptable accuracy and dimensional stability. However, for high-precision cutting, rotating solid carbide and also brazed tools still retain the lead. A one-piece integral cutter, ground with strict tolerance limits, always has the advantage in accuracy in comparison with an assembled tool with inserts. There is a viable indexable alternative that not only overcomes the lack of accuracy but improves the tool by making it both versatile and economical: an innovative yet simple modular cutter that can incorporate various replaceable solid carbide heads.

The concept of a cutting tool with mechanically clamped inserts pushed aside brazed cutting edge applications once the industry learned to produce sintered inserts with acceptable accuracy and dimensional stability. However, for high-precision cutting, rotating solid carbide and also brazed tools still retain the lead. A one-piece integral cutter, ground with strict tolerance limits, always has the advantage in accuracy in comparison with an assembled tool with inserts. There is a viable indexable alternative that not only overcomes the lack of accuracy but improves the tool by making it both versatile and economical: an innovative yet simple modular cutter that can incorporate various replaceable solid carbide heads. ISCAR’s tool families target different types of machining: MULTI-MASTER (milling and drilling); T-SLOT (milling slots and grooves); SUMOCHAM, CHAMIQDRILL and CHAMDRILL (drilling); BAYO T-REAM (reaming). Manufacturing replaceable heads for the tools is based on technologicallyadvanced pressing and sintering processes. There are two kinds of heads. One is a tool of decreased length usually made of solid carbide, whereas the second head features a specific pre-sintered shape that is brought to final dimensions by fine grinding. Advances in powder metallurgy have influenced the second type of head, while technological progress has succeeded in producing highly specific shapes for improved cutting action and chip control that are very difficult or even simply impossible to reach by using grinding operations (Pic. 5).

ISCAR’s tool families target different types of machining: MULTI-MASTER (milling and drilling); T-SLOT (milling slots and grooves); SUMOCHAM, CHAMIQDRILL and CHAMDRILL (drilling); BAYO T-REAM (reaming). Manufacturing replaceable heads for the tools is based on technologicallyadvanced pressing and sintering processes. There are two kinds of heads. One is a tool of decreased length usually made of solid carbide, whereas the second head features a specific pre-sintered shape that is brought to final dimensions by fine grinding. Advances in powder metallurgy have influenced the second type of head, while technological progress has succeeded in producing highly specific shapes for improved cutting action and chip control that are very difficult or even simply impossible to reach by using grinding operations (Pic. 5). The growth of modern technology opened the door for producing both the indexable inserts and the replaceable heads from cemented carbide in diverse shapes. This reflects the outcome of years of research and development in the field, and further illustrates ISCARs commitment to the development of machining performance. Essentially, an indexable cutting tool comprises only three components: the tool body, the insert or the head and a clamping element.

The growth of modern technology opened the door for producing both the indexable inserts and the replaceable heads from cemented carbide in diverse shapes. This reflects the outcome of years of research and development in the field, and further illustrates ISCARs commitment to the development of machining performance. Essentially, an indexable cutting tool comprises only three components: the tool body, the insert or the head and a clamping element.

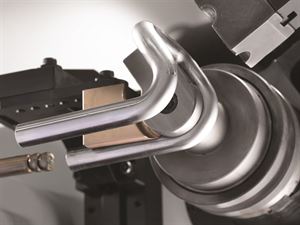

The family of machines comes in four models, for tubes up to 30, 35, 40 and 52 millimetres in diameter and inprocess right-hand and left-hand bending: the systems are all-electric with fixed and variable multi-radius capabilities and integrated loading and unloading systems.

The family of machines comes in four models, for tubes up to 30, 35, 40 and 52 millimetres in diameter and inprocess right-hand and left-hand bending: the systems are all-electric with fixed and variable multi-radius capabilities and integrated loading and unloading systems.