Increased participation by black owned suppliers in the country’s automotive sector and greater use of local components will be major themes of National Association of Automotive Component and Allied Manufacturers (NAACAM) Show incorporating the Durban Automotive Cluster’s National Localisation Indaba in Durban on April 5-6 2017.

NAACAM Executive Director Renai Moothilal said that working with its value chain partners, including the SA based OEMs, the Department of Trade and Industry and supporting agencies such as the AIDC, the NAACAM Show would be a practical tool to progress these issues.

Besides an exhibition focus of bringing in and highlighting black supplier companies, there are two conference sessions, dedicated to Black Supplier Development and Transformation, which would reflect on industry’s commitment while also showcasing existing success stories. The mainstream automotive economy, represented by an estimated 400 executive level delegates, including OEMS, tier 1s, tier 2s (including black-owned manufacturers) and stakeholders will gather to engage on these and other pertinent issues relevant to this crucial South African manufacturing sector.

“There are opportunities to drive transformation. Especially within the tier two space, it will be possible to develop a cache of black industrialists, reshaping the owner dynamics within this sector”, Moothilal says. “The entire sector is committed to transformation objectives and is taking proactive steps to foster and accelerate this development.”

Given the levels of government support for the automotive industry through the current Automotive Production and Development Programme (APDP) and other supporting instruments, such as the Black Industrialists Scheme, it is accepted that government will continue to push the automotive sector towards an ownership profile that matches demographic representation, with the most realistic way for this to happen being through the lower-tiered component segments, says Moothilal.

The inaugural NAACAM Show will take place in conjunction with the Durban Automotive Cluster’s National Localisation Indaba at the Durban ICC from April 5-6. It will be held every two years rotating across South Africa’s major automotive hubs.

Moothilal believes the Show will be a great platform for the sector to showcase its true capability. “We would like to see a deepening of the use of parts manufactured in South Africa, with many parts being imported by OEMs and component manufacturers. We must deepen our value chains.” Moothilal said The National Localisation Indaba delivered through NAACAM Show would connect qualified suppliers to buyers where these opportunities are known to exist.

The NAACAM Show conference will also deal with topics including Manufacturing Best Practice, The Automotive Vision and Masterplan, The Future of the Automobile, Leadership and Logistics and Supply Chain Management, delivered by industry, government and academic leaders in these fields.

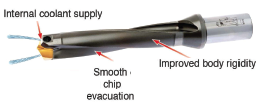

Available as a standard drill in 3xD and 5xD for a diameter range of 26mm to 41mm, the SpadeRush’s unique clamping technology enables operators to quickly change drill heads without removing the clamping screw from the holder.

Available as a standard drill in 3xD and 5xD for a diameter range of 26mm to 41mm, the SpadeRush’s unique clamping technology enables operators to quickly change drill heads without removing the clamping screw from the holder.