Sales by the Swiss mechanical and electrical engineering industries (MEM industries) performed very positively during the first half of 2017, increasing by 6.2% year-on-year.

A little disappointingly, new orders received fell by 3.4%. Overall, however, the key indicators point to a positive trend for the MEM industries over the coming months, while the purchasing managers’ index for the industry promises robust growth almost worldwide. MEM employers’ business expectations are optimistic. And last but not least, the weakening of the Swiss franc against the euro is generating additional momentum and allowing MEM companies to improve their margins again.

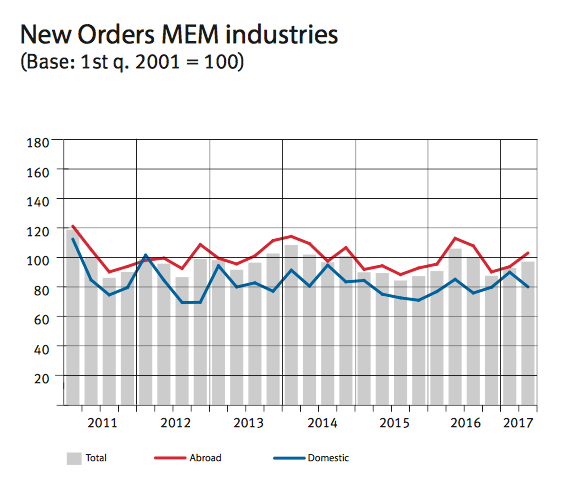

Sales in the Swiss mechanical and electrical engineering industries (MEM industries) rose by 3.3% year-on-year in the second quarter of 2017. For the first half of the year as a whole, sales rose by 6.2%. This is the second-strongest first-half increase in ten years. New orders received fell by 8.3% in the second quarter of 2017 compared with the same period of 2016 after having risen by 2.3% in the first quarter. Overall, order intake in the first half of 2017 fell by 3.4%.

In comparison with the higher sales figure, this trend is a little disappointing. However, order intake in the second quarter of 2016 was so substantial that the current decline can be attributed in large part to this high baseline. The index figure for new orders had reached a comparatively high level at end- June 2017 and now exceeds the previous year’s average.

MEM industries employed 317,300 people in the first quarter of 2017 – 1.0% fewer than in the same period a year ago. The FSO (Federal Statistical Office) employment figures for the second quarter of 2017 are not yet available. Capacity utilization among MEM companies reached 88.0% in the second quarter of 2017, exceeding its long-term average of 86.4%.

According to figures from the Swiss Customs Administration, exports by MEM industries collectively rose by 2.3% year-on-year in the first half of 2017. Total merchandise value was CHF 32.4 billion. Exports grew in all key sales markets. Exports to the USA (+6.8%) and EU (+2.7%) performed particularly well. The growth in exports to Asia was considerably weaker (+0.2%). Looking at individual product segments, metal industry exports rose by 11.0%, electrical and electronics exports by 1.7%, and precision instruments exports by 1.5%. Only in the mechanical engineering segment did exports fall in the first half of the year (-0.3%).

Sales figures have now been improving, in some cases significantly, for three consecutive quarters compared to the respective yearback periods. The majority of indicators are signalling that the positive trend is set to continue in the coming months too. The PMI (Purchasing Managers’ Index) for the industry, a key leading indicator, currently points to robust growth almost worldwide. Swissmem member companies’ expectations are optimistic. According to the latest survey, 51% of companies are anticipating increases in orders from abroad in the next 12 months. Just 8% fear a decline in orders. And last but not least, the latest development in the Swiss franc-euro exchange rate is providing additional momentum.

Should the weakening of the franc prove sustained, margins for MEM industry companies may well finally start to pick up again. For Swissmem President Hans Hess this is pivotal: “the weaker franc is giving MEM companies the chance to finally start earning some money again after ten challenging years, and to invest this in the future.”

To ensure a successful recovery for the MEM industries, the action areas of innovation, digitalization, the labour market, access to markets, growth finance, and training and development will be paramount. Companies should invest primarily in innovation and digitalization so as to boost their competitiveness and Switzerland’s status as a production hub. The Swiss government can support innovation in industry by extending knowledge and technology transfer into businesses still further.

With regard to digitalization, Swissmem expects the government to exercise restraint in its regulation of the digital environment, to invest in cyber security and cyber defence, and to rapidly expand the administration’s portfolio of digital services. Moreover, policymakers need to ensure that the liberal labour market is preserved, and to secure and further extend access to the world markets – as far as possible on a completely non-discriminatory basis.